⏱ 3 min

Do’s ✔️

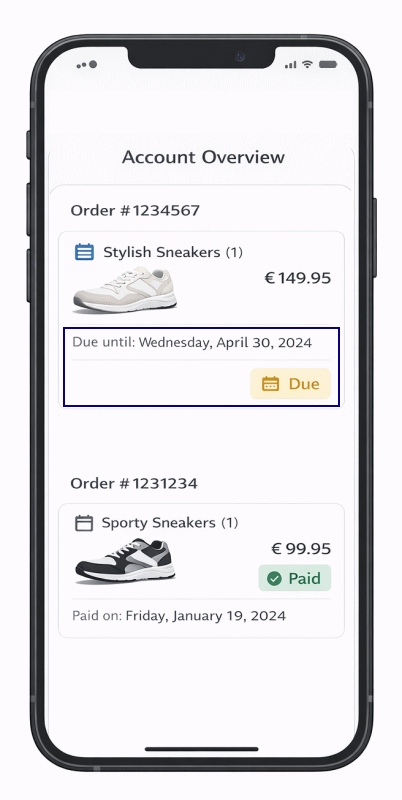

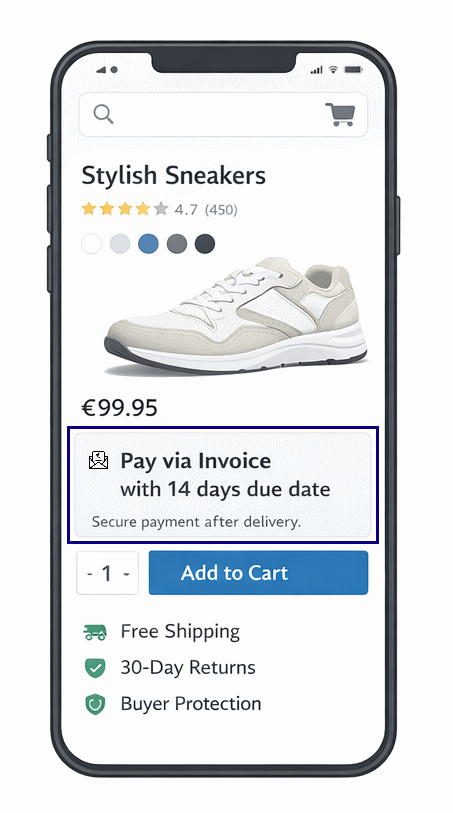

- Show the due date.

- Highlight that payments can be done after delivery.

Don’ts ❌

- Don’t show any Ratepay logo or state Ratepay as payment provider — stay within your brand.

Do’s ✔️

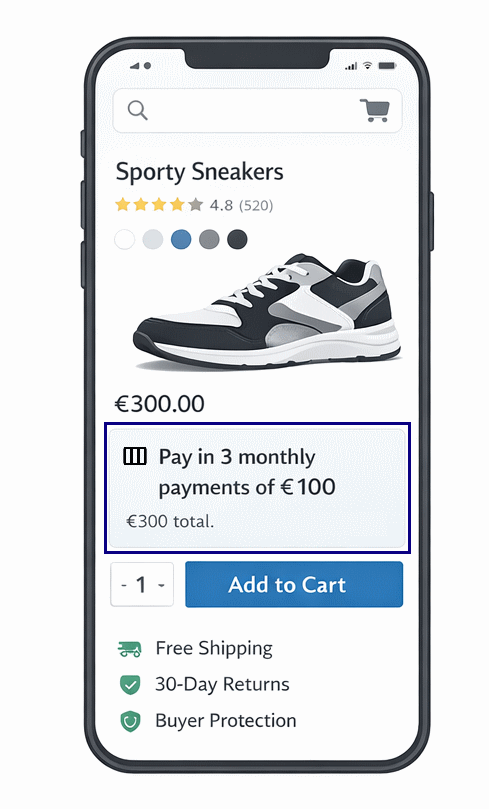

- Show the monthly amount.

Don’ts ❌

- Don’t show any Ratepay logo or state Ratepay as payment provider — stay within your brand.

Do’s ✔️

- Implement an address validation service to improve acceptance quota.

- Show the hint that the billing address needs to match with the registered address (Meldeadresse) for Ratepay payment methods.

Do’s ✔️

General

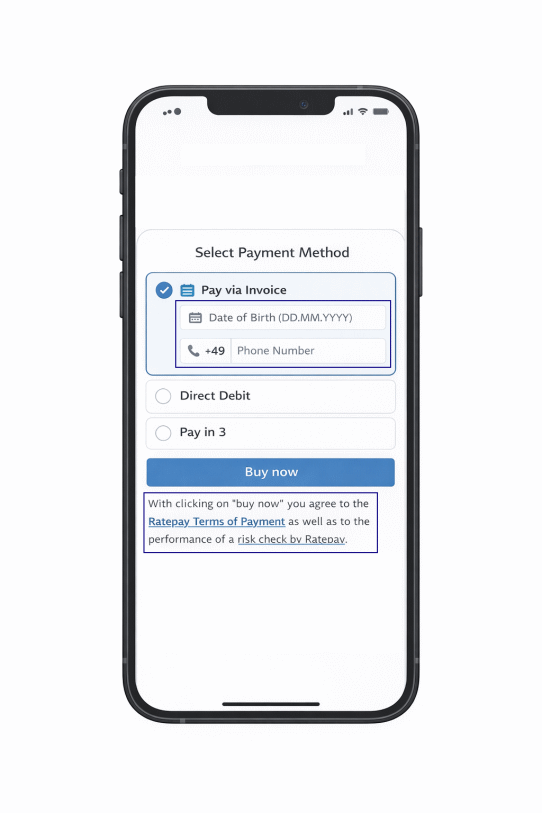

- Evaluate which payment methods can be shown, based on basket amount.

- Execute Device Fingerprinting when a Ratepay payment method was selected.

- Ask & validate Date of Birth and/or telephone number (if not done before).

- Show legal requirements .

Direct Debit

- Ask & validate Bank Account Owner & IBAN & get SEPA mandate

Pay in 3

Don’ts ❌

General

- Don’t show any Ratepay logo or state Ratepay as payment provider — stay within your brand.

Do’s ✔️

- Implement Idempotency for follow-up operations.

- Forward Ratepay transaction details (e.g. payment references ) to your ERP system.

- Consider transaction expiration date.

Don’ts ❌

- Call Ratepay APIs from frontend.

Do’s ✔️

Open Invoice

- State the bank details & legal requirements, provided by Ratepay.

- Forward the transaction specific payment_references to your ERP system / system for invoice generation and state it on your invoices.

Direct Debit

- State, that the SEPA prenotification will be sent separately.

Pay in 3

- State, that the installment plan will be sent separately.

Don’ts ❌

General

- Show your bank details on the invoices, to avoid a money transfer to you instead of Ratepay.

Do’s for success ✔️

- Show success page & send confirmation to buyer.

Don’ts for failure ❌

- Show a generic error reason.

- Still show Ratepay payment methods in case of hard risk rejections.